Download Free eBook:How to Read a Balance Sheet - Free chm, pdf ebooks download. The Cashflow Balance Sheet app is a simple and fun app that helps you play financial simulation games and/or track your personal Assets. Free Publisher: In A Day Development Downloads: 75.

Most business owners don’t dive into entrepreneurship because they are excited about the accounting process, but a basic understanding of accounting sets a successful business apart from those that struggle. Fortunately, many places and people are willing to help you learn, including your accountant, your bookkeeper (if you employ one and don’t do the books yourself), as well as the resources at SCORE.

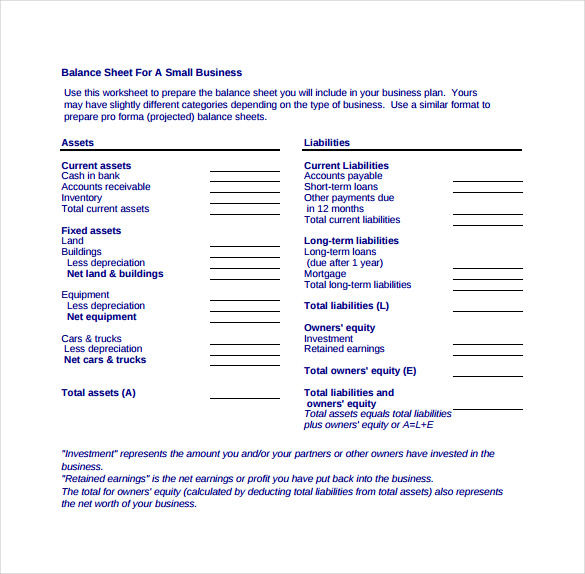

One of the most important financial documents every business owner needs to understand is the balance sheet.

Your balance sheet helps you understand the relationship between your income and your expenses, so you can maintain profitability. This document will help you become a profit expert in your business because it will allow you to work with your business’ financial numbers to build a workable balance. This incredibly powerful tool not only tells you where you’ve been, but it will help you forecast into the future.

How will the year's operations affect assets, debts and owners’ equity? For example, if you are planning significant sales growth in the coming year, go through the balance sheet item by item and think about the probable effects of assets.

Balance Sheet Pdf Free Download Free

Technical Tips on Using the Template

1. Your firm's balance sheet no doubt has more lines than this template. For clarity and ease of analysis, we recommend you combine categories to fit into this compressed format.

2. As always for projections, we recommend that you condense your numbers. Most people find it useful to express the values in thousands, rounding to the nearest hundred dollars; for example, $11,459 would be entered as 11.5.

3. In the Fixed Assets section, the 'LESS accumulated depreciation' figure is the total of all depreciation accrued over the years on all fixed assets still owned by the company. Be sure to enter it as a negative number so the spreadsheet will subtract it from Total Fixed Assets.

4. In Owners' Equity, 'Retained Earnings-Beginning' is retained earnings as of the last historical balance sheet or the end of the last fiscal year. 'Retained Earnings-Current' is net profit for the period of the projections, less any owner's draw (for partnerships and proprietorships) or dividends paid (for corporations).

Learn how OnDeck can help your small business.

Have a question about this balance sheet template? Connect with a SCORE mentor online or in your community today!

A balance sheet is a financial statement that reflects assets, liabilities and owners’ equity. Get a free balance sheet template, example, and guide.

You might be new to the business industry if you are reading this, but everyone should know what a balance sheet is. What does a balance sheet do anyways? There are many factors that encourage a business or sole entrepreneur to use balance sheets. In financial accounting, the definition of a balance sheet is a summary of the financial balances of some business organization such as a sole proprietorship or corporation. An example of one of these companies would be an LLC or LLP. The assets and ownership of something is listed in a balance sheet in a specific date form. It is often described as a short snapshot of how the company’s finances are doing.

Balance Sheets Must Include

A standard balance sheet includes the following: assets, liabilities, or ownership equality. The main objectives of assets are usually listed first, followed by liabilities. The differences between these two are widely known as the net assets or the net worth of the company, inferring to the accounting equation. And of the four fundamental financial statements in a company, the balance sheet is the only statement that refers to a special point in a time of year. There are two different types of balance sheets and that is what I’m going to be talking about today.

Sample Balance Sheet Formats for 2019

A personal balance sheet is used by entrepreneurs and singular businessmen around the world today. This type of balance sheet would include the statements of current assets, such as the net profit of incoming cash. Some balance sheets include the statements of bank accounts (checking and savings accounts). Liabilities of the owner are listed also, such as the total amount in debt to a particular person or a type of company you are paying to. For example, if you were pushed back two months on a lease for your business, then you would include that in the personal balance sheet. A personal balance sheet is great for financing.

Another kind of balance sheet is called the US small business balance sheet. A small business balance sheet lists current assets, such as money. In its subcategories, accounts receivables are listed along with inventory of the current assets. This type of balance sheet includes long-term assets such as stock and estate. All long-term debts or any tangencies must be listed in a US small business balance sheet. Warranties are noted in the footnotes of the balance sheet. The guidelines for all balance sheets are given by the International Accounting Standards Board and numerous organizations and companies in that particular nation. If it is applicable to the business, all types of assets, liabilities, and equities should be listed in this type of balance sheet.

As a newbie of the business industry, you’ve now learned that personal financing is needed in order for your business to run properly. Without one of the most basic and fundamental financing methods, it is possible that your business may get shut down. To avoid that, you must correctly finance your assets, liabilities, and equities.